Federal workers across North Dakota — including those in Bismarck — impacted by the federal shutdown can now apply for 2% short-term loans through the new Furloughed Federal Employee Relief Program, underwritten by the state’s Bank of North Dakota.

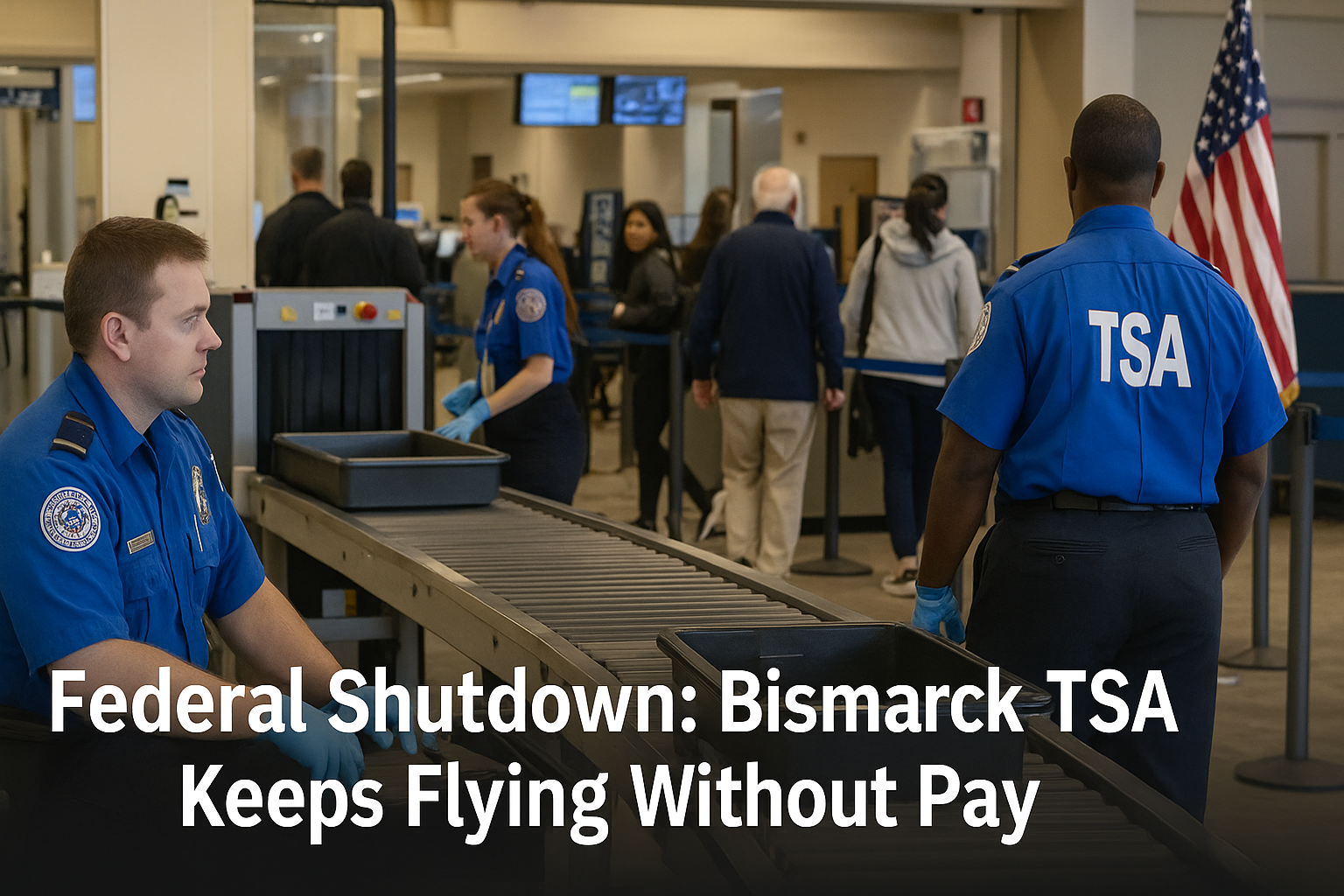

The 2025 federal government shutdown began Oct. 1 after Congress failed to pass appropriations, putting nearly 900,000 employees into furlough or working without pay.

In response, North Dakota’s Industrial Commission, led by Governor Kelly Armstrong (with the agriculture commissioner and attorney general), has mobilized to offer financial relief.

The state program is administered via Bank of North Dakota (BND), which will buy the loan from local banks or credit unions.

To qualify, applicants must:

Be North Dakota residents (or military stationed in ND) • Submit a recent paystub

Apply between Oct. 10, 2025 and Jan. 9, 2026 or until the shutdown ends, whichever comes first

The loans cover up to three months of lost net pay, with repayment over five months after federal pay resumes.

North Dakota estimates nearly 9,200 federal workers statewide could be eligible.

“In a time where people have sometimes lost faith in government, we want to … say we’re here to help.” — Gov. Kelly Armstrong.

“Most of the programs we roll out, North Dakotans pay their bills.” — Don Morgan, BND CEO

In Bismarck and surrounding counties, many federal employees work at the U.S. District Court, Veterans Affairs, IRS, Census, USDA, Air Force (Minot, Grand Forks), among others. For those in the region who rely on regular pay to meet rent, utilities, and expenses, even short gaps can cause hardship.

Local banks in Bismarck and Mandan are being urged to partner in the program — meaning that affected federal employees don’t have to travel far or deal with out-of-state lenders to apply.

One Bismarck-area federal worker (who asked to remain anonymous) shared:

“Missing a paycheck hits us hard — I was worried about covering groceries. This program gives me breathing room until Congress acts.”

The federal government may delay or withhold back pay, as recent White House memos suggest workers aren’t automatically guaranteed retroactive compensation unless Congress explicitly funds it. If a worker gets laid off permanently or does not receive back pay, will the state try to collect on the loan? That remains to be clarified.

BND and state officials are banking on the Government Employee Fair Treatment Act of 2019 (GEFTA), which requires retroactive pay for federal workers after lapses in appropriations.

Federal employees in the Bismarck region: start gathering your latest pay stub and verify residency. Visit the official Furloughed Federal Employee Relief Program site via BND for details and application forms. Reach out to your local bank or credit union — many are already coordinating with BND under this program. Monitor congressional developments — if federal funding is restored, the loans will be repaid quickly.

Contact your state legislators or U.S. Congress members to advocate for swift passage of funding and protection of federal worker rights.

As the federal shutdown drags on, Bismarck-area residents see a tangible safety net rising — not from Washington, but from their state capital. North Dakota’s loan initiative offers a vital bridge for local public servants caught between partisan deadlock and mounting bills. While the program doesn’t erase the risk of delayed or denied back pay, it underscores one truth: for Bismarck and beyond, home-grown solutions may offer the greatest stability in uncertain times.